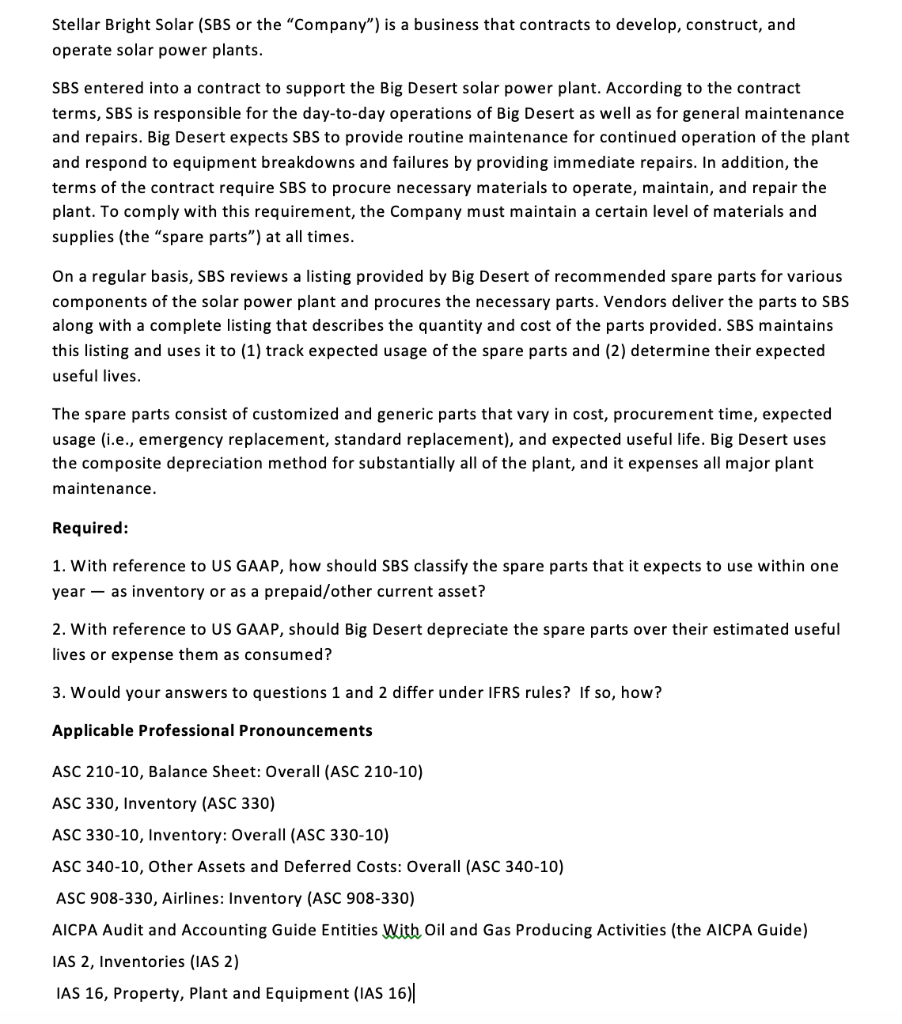

Normally the depreciable life of solar panels is 85 of the full solar system cost which may be depreciated roughly as follows.

Estimated useful life for solar panels for depreciation.

With half of the 26 tax credit deducted from the price the basis of depreciation for the solar system is 435 000 and the total savings from depreciation will be 134 850.

Established a basis in solar panels and related equipment for purposes of claiming an energy credit under secs.

Qualifying solar energy equipment is eligible for a cost recovery period of five years.

So solar panels meet all the three criteria.

Not only do solar panels have a useful life of five years they are also used for the production of renewable energy.

Satisfied the requirements of then applicable sec.

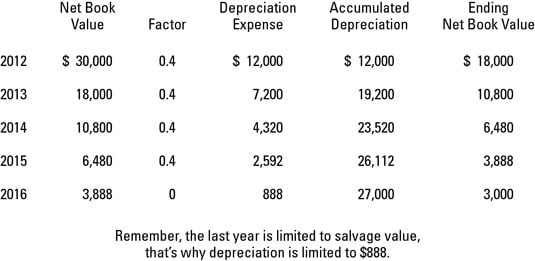

But let s take a look at the five year depreciation schedule.

Let s have a look at how depreciation in solar benefits small businesses.

Had sufficient amounts at risk under sec.

The basis of depreciation for the widget machine is the full 500 000 for a savings of 155 000.

Commercial solar arrays and macrs depreciation.

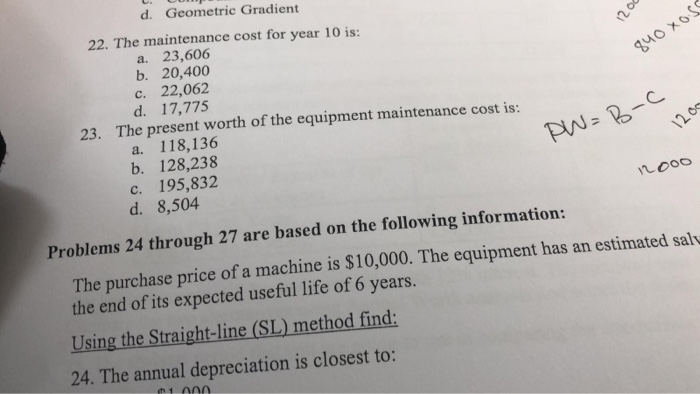

Year 1 20 year 2 32 year 3 19 2 year 4 11 5 year 5 11 5 and year 6 5 8.